Credit Card Chargebacks 2026: Your Rights and Effective Exercise

Anúncios

Credit card chargebacks in 2026 provide consumers with a vital mechanism to dispute unauthorized or erroneous transactions, ensuring financial protection against fraud and merchant non-compliance within an updated regulatory landscape.

Anúncios

Are you aware of your financial protections in an increasingly digital world? Understanding your rights regarding credit card chargebacks in 2026 is more crucial than ever. This guide will equip you with essential knowledge to navigate the evolving landscape of consumer protection.

Anúncios

Understanding the Basics of Credit Card Chargebacks in 2026

Credit card chargebacks are a consumer protection mechanism allowing cardholders to reverse a transaction directly through their issuing bank, rather than relying solely on the merchant for a refund. In 2026, these protections remain a cornerstone of consumer trust in digital and physical commerce, with some refinements reflecting technological advancements and persistent fraud threats.

The fundamental principle behind a chargeback is to safeguard consumers from fraudulent activity, disputes with merchants, or issues where services or goods are not delivered as promised. It effectively shifts the burden of proof from the cardholder to the merchant in many cases, making it a powerful tool for consumer advocacy. While the core mechanisms have been stable for years, 2026 brings nuances in how these rights are exercised and the evidence required.

Historically, chargebacks have been a last resort. However, with the proliferation of online shopping and subscription services, their relevance has only grown. Consumers frequently encounter situations where a merchant might be unresponsive, out of business, or simply unwilling to resolve a dispute. In these scenarios, knowing how and when to initiate a chargeback becomes indispensable. The process involves specific timelines and documentation, which we will explore in detail.

Key Regulations Governing Chargebacks: What’s New for 2026?

The regulatory framework for credit card chargebacks in the United States primarily stems from the Fair Credit Billing Act (FCBA) for credit cards and the Electronic Fund Transfer Act (EFTA) for debit cards. While these foundational laws remain intact, 2026 sees continued emphasis on digital transaction security and clearer guidelines for emerging payment technologies.

For credit card transactions, the FCBA provides a robust shield against billing errors, unauthorized charges, and goods or services not delivered as agreed. It mandates that consumers have 60 days from the date the first bill containing the error was mailed to dispute the charge. However, many card networks and issuers offer more generous timeframes, often up to 120 or even 180 days, especially for complex cases like non-delivery.

Evolving Interpretations and Digital Transactions

- Digital Wallets and Tokenization: Regulations are increasingly clarifying how chargeback rights apply to transactions made via digital wallets (e.g., Apple Pay, Google Pay) and tokenized payments. While the underlying card network rules still apply, the process for identifying the original transaction might differ.

- Subscription Services: With the rise of subscription models, there’s a greater focus on clear disclosure of terms and conditions. Disputes arising from unexpected renewals or difficulty canceling subscriptions are often favorable for consumers if proper consent was not obtained or cancellation was unduly hindered.

- Enhanced Fraud Detection: Card networks and banks are leveraging advanced AI and machine learning to detect and prevent fraudulent transactions, which, while beneficial, can sometimes lead to legitimate transactions being flagged. Understanding how to appeal these can be part of the chargeback process.

The payment card industry, including Visa, Mastercard, American Express, and Discover, also maintains its own set of rules and reason codes for chargebacks, which are often more detailed than federal law. These rules are continually updated to address new types of fraud and transaction disputes. Staying informed about these evolving interpretations is key for both consumers and merchants.

Common Scenarios for Initiating a Credit Card Chargeback

Knowing when to initiate a chargeback is as important as knowing how. While the specific circumstances can vary, several common scenarios frequently lead to successful chargeback claims. Understanding these can help you identify if your situation qualifies for this powerful consumer protection.

Types of Chargeback Scenarios

- Unauthorized Transactions: This is perhaps the most straightforward reason. If your credit card was used without your permission, whether due to theft, skimming, or a data breach, you are generally protected under federal law and card network rules.

- Goods or Services Not Received: You paid for an item or service, but it was never delivered, or the service was never rendered. This includes situations where a business closes down before fulfilling orders.

- Defective or Not as Described: The product or service you received is significantly different from what was advertised, or it is broken/defective upon arrival. This often requires you to demonstrate the discrepancy.

- Duplicate Billing: You were charged twice for the same transaction. This is typically an easy dispute to resolve with clear evidence of two identical charges.

- Incorrect Amount Charged: The amount charged to your card is different from the agreed-upon price.

- Credit Not Processed: You returned an item or canceled a service, and the merchant promised a refund, but it never appeared on your statement.

Before initiating a chargeback, it is almost always recommended to first attempt to resolve the issue directly with the merchant. This demonstrates good faith and can be a requirement from your card issuer. Document all communications, including dates, names of representatives, and summaries of conversations. This evidence will be crucial if you proceed with a chargeback.

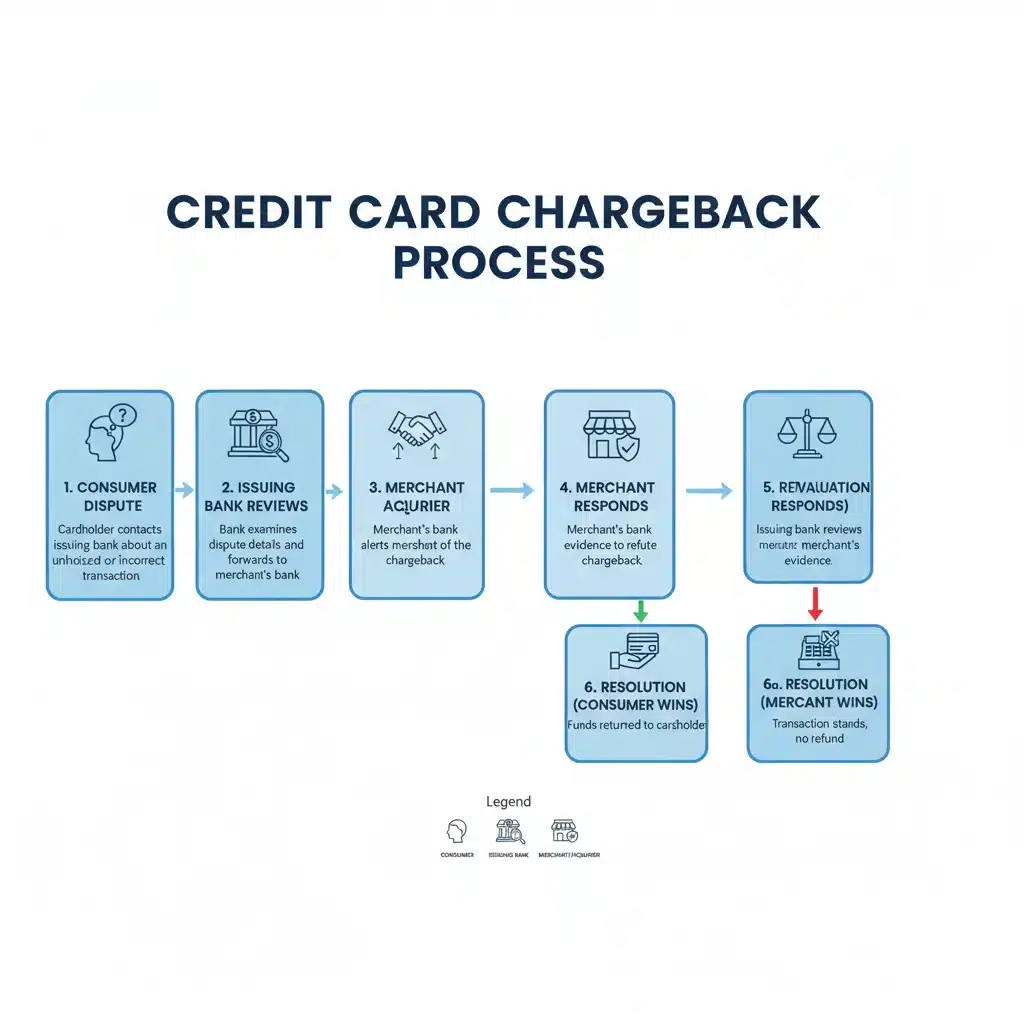

The Step-by-Step Process of Filing a Chargeback in 2026

Filing a credit card chargeback might seem daunting, but following a structured process can significantly increase your chances of success. In 2026, the essential steps remain largely consistent, focusing on clear communication and thorough documentation. Preparation is key to navigating this process effectively.

The first and often overlooked step is to gather all relevant documentation. This includes transaction receipts, order confirmations, communication records with the merchant (emails, chat logs, call summaries), photos of defective goods, and any other evidence supporting your claim. The more detailed your evidence, the stronger your case will be.

Initiating the Dispute with Your Bank

- Contact Your Card Issuer: Reach out to your credit card company or bank as soon as you identify an issue. Most banks offer online dispute forms, phone numbers, or even secure messaging platforms for this purpose. Be prepared to provide your account number, the transaction details (date, amount, merchant name), and a clear explanation of why you are disputing the charge.

- Submit Supporting Documentation: Your bank will likely request the evidence you’ve collected. Ensure all documents are clearly labeled and easy to understand. Some banks allow digital uploads, while others might require mail or fax.

- Understand Timelines: Be aware of the deadlines for filing a dispute. While the FCBA specifies 60 days, many banks offer extended periods. Missing these deadlines can significantly weaken your claim.

Once you’ve submitted your dispute, your bank will investigate the claim. This often involves contacting the merchant’s bank to present your case. The merchant then has an opportunity to respond with their own evidence. This back-and-forth process can take several weeks or even months, depending on the complexity of the dispute. During this time, the disputed amount is typically credited back to your account temporarily, pending the investigation’s outcome. It’s vital to monitor your account and respond promptly to any further requests from your bank.

Maximizing Your Chances of a Successful Chargeback

While the chargeback mechanism is designed to protect consumers, success is not guaranteed. Several factors can influence the outcome of your dispute. By understanding these elements and proactively addressing them, you can significantly improve your odds of a favorable resolution for your credit card chargebacks in 2026.

One of the most critical aspects is the strength and clarity of your evidence. A well-documented case leaves little room for doubt and provides your bank with the necessary ammunition to challenge the merchant. Vague claims or a lack of supporting documents often result in the dispute being denied. Remember, the burden of proof is initially on you, the cardholder, to demonstrate a legitimate problem.

Key Strategies for Success

- Act Promptly: Time is often of the essence. The sooner you dispute a transaction, the fresher the details are in your mind, and the more likely you are to meet your bank’s deadlines. Delays can be interpreted as acceptance of the charge.

- Exhaust Merchant Resolution: Always attempt to resolve the issue directly with the merchant first. This shows your bank that you’ve made a good-faith effort. Keep detailed records of these attempts.

- Be Specific and Factual: When explaining your dispute to the bank, stick to the facts. Avoid emotional language and clearly articulate why the charge is incorrect or unauthorized.

- Understand Reason Codes: While you don’t need to be an expert, a basic understanding of the common chargeback reason codes can help you frame your dispute more effectively. Your bank will assign one to your case.

Maintaining clear and consistent communication with your bank throughout the process is also vital. Respond quickly to any requests for additional information and keep copies of everything you submit. If your initial dispute is denied, don’t be afraid to ask for clarification and consider appealing the decision, especially if you believe new evidence has surfaced or your case was misunderstood. Persistence, coupled with strong evidence, is often the key to a successful chargeback.

Avoiding Chargeback Issues: Best Practices for Consumers

While chargebacks are a powerful tool, prevention is always better than cure. Adopting smart financial habits and exercising caution in your transactions can significantly reduce the likelihood of needing to file a chargeback. These best practices are particularly relevant in 2026, given the increasing sophistication of online fraud and evolving consumer experiences.

Vigilance is your first line of defense. Regularly reviewing your credit card statements for any unfamiliar or incorrect charges can help you catch issues early. Many banks offer real-time transaction alerts via email or mobile apps, which can be invaluable for immediate detection of unauthorized activity.

Proactive Measures for Financial Security

- Monitor Statements Regularly: Make it a habit to check your credit card statements at least once a month, or even more frequently if you use your card often. Look for any discrepancies, no matter how small.

- Secure Online Shopping: Only purchase from reputable websites that use secure connections (look for ‘https://’ in the URL and a padlock icon). Be wary of unsolicited emails or pop-ups offering deals that seem too good to be true.

- Protect Personal Information: Never share your credit card number, CVV, or PIN through unsecured channels. Be cautious about public Wi-Fi networks when making purchases.

- Understand Merchant Policies: Before making a significant purchase, especially online, familiarize yourself with the merchant’s return, refund, and cancellation policies. This can help prevent disputes later.

- Keep Records: Maintain digital or physical copies of all your transaction receipts, order confirmations, and any correspondence with merchants. These records are invaluable if a dispute arises.

Furthermore, consider using virtual card numbers or payment services that offer an extra layer of security for online transactions. These services can mask your actual credit card number, reducing exposure to potential fraud. By integrating these practices into your financial routine, you can significantly enhance your protection against issues that might otherwise lead to a chargeback, ensuring a smoother and more secure financial experience in 2026.

| Key Aspect | Brief Description |

|---|---|

| Consumer Rights | Federal laws (FCBA, EFTA) protect against fraud, errors, and unfulfilled services in credit card transactions. |

| Common Scenarios | Includes unauthorized charges, non-delivery, defective goods, duplicate billing, and incorrect amounts. |

| Filing Process | Contact bank, submit detailed evidence, and adhere to dispute timelines for investigation. |

| Maximizing Success | Act promptly, gather strong evidence, attempt merchant resolution, and maintain clear communication. |

Frequently Asked Questions About Credit Card Chargebacks

While the Fair Credit Billing Act (FCBA) generally allows 60 days from the statement date, many card issuers and networks offer extended periods, often 120 to 180 days, especially for non-delivery or continuous service issues. It’s always best to check with your specific bank for their exact policy.

Yes, in most cases, it is highly recommended and often required by your card issuer to attempt to resolve the issue directly with the merchant first. This demonstrates a good-faith effort and strengthens your chargeback case if the merchant is unresponsive or unhelpful.

You should provide all relevant documentation, including receipts, order confirmations, screenshots of product descriptions, emails or chat logs with the merchant, proof of return (if applicable), and any other information supporting your claim. The more detailed, the better.

Yes, after you file a chargeback, your bank contacts the merchant’s bank, and the merchant has the right to present their side of the story and provide evidence to counter your claim. This is part of the chargeback investigation process.

If your chargeback is denied, your bank will typically provide a reason. You may have the option to appeal the decision, especially if you have new evidence or believe there was a misunderstanding. Review your bank’s policies on appeals.

Conclusion

Navigating the world of credit card chargebacks in 2026 empowers consumers with essential tools to protect their financial well-being. Understanding your rights, recognizing valid dispute scenarios, and meticulously following the filing process are paramount to a successful outcome. By adopting proactive financial habits and staying informed about evolving regulations, you can significantly minimize risks and confidently exercise your consumer protections. Chargebacks remain a vital safeguard, offering peace of mind in an increasingly complex digital economy.