How to protect yourself from identity theft effectively

Anúncios

To protect yourself from identity theft, use strong passwords, monitor your accounts regularly, and utilize resources like the FTC and credit bureaus for assistance if you suspect your identity has been compromised.

How to protect yourself from identity theft is a crucial concern in our digital age. With so much of our lives online, are you taking the right steps to keep your information safe? Let’s explore how to secure your identity and prevent potential threats.

Anúncios

Understanding identity theft

Understanding identity theft is vital in today’s digital world. This growing threat can impact anyone, especially those who are unaware of how it occurs. By recognizing the signs and methods of identity theft, you can take steps to protect yourself.

Anúncios

What is identity theft?

Identity theft happens when someone unlawfully uses your personal information, such as your name, Social Security number, or bank account details, to commit fraud. This misuse can lead to serious financial consequences and can affect your credit score.

Common methods of identity theft

Thieves use various tactics to steal identities. Here are some common methods:

- Phishing attacks via email or messages

- Skimming devices on ATMs or card readers

- Data breaches from companies and online services

- Mail theft to access sensitive documents

Awareness is the first step toward prevention. Many victims often share similar experiences, which can make it easier to recognize potential threats. Consider how often you share your personal information online and think about whether it is necessary.

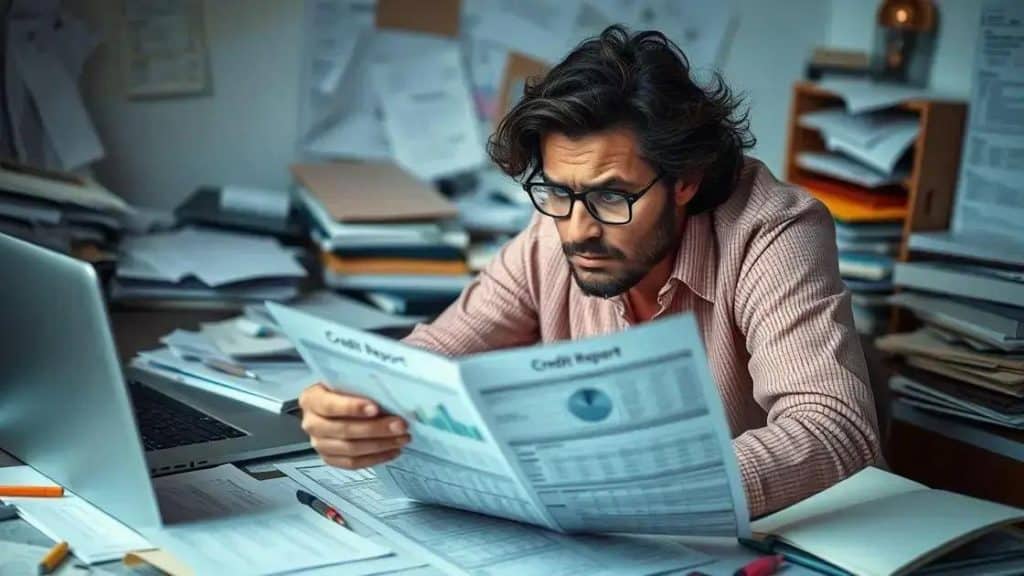

Another important aspect is to monitor your accounts regularly. This includes reviewing bank statements and credit reports to catch any unauthorized activity early. Setting up alerts for unusual transactions can also help keep your information secure.

In addition to monitoring, using strong and unique passwords for your accounts is essential. Avoid simple passwords that are easy to guess. Instead, combine letters, numbers, and symbols to create a password that is hard to crack.

As you can see, understanding how identity theft works is crucial for safeguarding your personal information. By staying informed about the risks and taking proactive measures, you can significantly reduce your chances of becoming a victim.

Common tactics used by identity thieves

Common tactics used by identity thieves encompass several clever techniques they utilize to steal your personal information. Understanding these tactics is crucial for effective prevention. Identity thieves are always evolving their methods, which makes awareness critical.

Phishing Attacks

One of the most common tactics is the use of phishing attacks. Thieves send fake emails or messages that appear legitimate, tricking victims into revealing sensitive information. They may ask for login details or financial data, disguising their correspondence as urgent. Always be cautious about clicking links in unsolicited emails.

Skimming Devices

Skimming involves the unlawful capture of information from credit or debit cards using devices placed on ATMs or gas station pumps. These devices collect card details without the victim’s knowledge. To protect yourself, inspect card readers for anything suspicious before using them.

Data Breaches

Data breaches can occur when companies fail to secure customers’ personal information effectively. When these breaches happen, hackers can access a large quantity of sensitive data. It’s important to stay informed about companies you trust. They should have robust security measures in place to protect your data.

Some identity thieves resort to mail theft to gather personal information, including bank statements and credit card offers. They may steal physical mail from your mailbox or pose as postal workers. Installing a secure mailbox can help reduce this risk.

Lastly, social engineering plays a significant role in identity theft. Thieves often manipulate individuals to gain access to sensitive information. They might call you, pretending to be from your bank or a reputable company, and ask you to verify your identity. Always verify the caller’s identity by contacting the company directly before sharing any personal information.

Steps to safeguard your personal information

Steps to safeguard your personal information are crucial in protecting yourself from identity theft. By implementing a few important strategies, you can greatly reduce your risk. Start by being mindful of the information you share online and offline.

Use strong passwords

Always create strong and unique passwords for your accounts. Avoid using simple passwords, like ‘123456’ or your name. A robust password should include a mix of letters, numbers, and symbols. Change your passwords regularly and never share them.

Enable two-factor authentication

Two-factor authentication (2FA) adds an extra layer of security. This means that even if someone has your password, they still need another form of verification to access your account. Many services offer this option, so make sure to enable it whenever possible.

Be cautious with personal information

Think before you share personal details. Verify the legitimacy of websites before entering your information. Always look for secure connections, indicated by “https://” in the URL. Additionally, be wary of unsolicited messages asking for personal data.

Monitor your accounts

Regularly check your bank and credit card statements. Look for any unauthorized transactions and report them immediately. Keeping an eye on your accounts allows you to catch issues early.

If you suspect identity theft, place a fraud alert on your credit report. This warns creditors to take extra steps to verify your identity before opening new accounts in your name. You may also consider freezing your credit, which can help prevent new accounts from being opened without your permission.

In addition to these steps, educate yourself about potential threats. Stay informed about the latest scams and tactics used by identity thieves. The more you know, the better prepared you will be to protect your personal information.

How to respond to a potential identity theft

How to respond to a potential identity theft situation can be overwhelming, but knowing the steps to take can help you regain control. If you suspect that your identity has been compromised, acting quickly is essential to minimize damage.

Gather information

The first step is to gather all relevant information. Document any suspicious activity you’ve noticed, such as unauthorized charges or unfamiliar accounts. This information will be crucial when you report the theft.

Contact your bank and creditors

Reach out to your bank and any relevant creditors immediately. Inform them of your concerns and ask to monitor your accounts for unusual transactions. They may recommend freezing your accounts or taking other protective measures.

Place a fraud alert

Consider placing a fraud alert on your credit reports. This alert notifies lenders to take extra steps to verify your identity before opening new accounts. You only need to contact one of the three major credit bureaus to request this alert, and they will notify the others.

- Equifax

- Experian

- TransUnion

File a police report

If you notice any fraudulent activity, consider filing a police report. This document can be valuable when dealing with creditors and showing that you’ve taken action to protect yourself. Provide as much detail as possible about the incidents.

Report to the Federal Trade Commission (FTC)

Visit the FTC’s website to report identity theft. They provide resources and a recovery plan tailored to your situation. This report can also help you document your case when working with financial institutions.

After taking these steps, continue to monitor your accounts regularly. You may want to request free credit reports from the credit bureaus to keep track of any changes. Staying vigilant and informed is key to safeguarding your identity.

Resources for further assistance

Resources for further assistance are essential for anyone looking to protect their identity. The right tools and information can empower you to respond effectively if you suspect identity theft.

Federal Trade Commission (FTC)

The FTC provides valuable resources on identity theft. They offer guidance on how to report theft and access a recovery plan tailored to your needs. Their website is a great starting point for anyone seeking help.

Credit Bureaus

The three major credit bureaus—Equifax, Experian, and TransUnion—provide additional resources and tools. They allow you to check your credit reports for free once a year. This can help you track any unauthorized activity and ensure your credit remains secure.

- Equifax: Access credit monitoring services.

- Experian: Offers additional identity protection resources.

- TransUnion: Provides identity theft resources and customer support.

Identity Theft Protection Services

Consider subscribing to an identity theft protection service. These services monitor your personal information across various platforms and alert you to suspicious activity. They often provide recovery assistance should you become a victim.

Local Law Enforcement

If you experience identity theft, you may need to involve local law enforcement. They can help with filing a report, which is essential for reporting identity theft to creditors and clearing your name.

Lastly, online resources and community support groups can offer advice and shared experiences. Learning from others who have faced similar situations can be incredibly helpful in navigating identity theft challenges.

Conclusion:

To effectively protect yourself from identity theft, it’s crucial to stay informed and take proactive measures. Understand the tactics used by thieves and know how to respond if your identity is compromised. Utilize available resources, such as credit bureaus and identity theft protection services, to ensure your personal information remains secure. By following these steps, you can minimize your risks and feel empowered in safeguarding your identity.

FAQ – Frequently Asked Questions about Protecting Yourself from Identity Theft

What should I do first if I suspect identity theft?

Immediately gather any suspicious activity you have noticed and contact your bank to report your concerns.

How can I protect my personal information online?

Use strong, unique passwords for each account and enable two-factor authentication wherever possible.

What resources are available for identity theft assistance?

The Federal Trade Commission (FTC) and the three major credit bureaus provide guidance and resources for identity theft recovery.

How often should I check my financial statements?

Regularly monitor your bank and credit card statements, ideally every month, to catch any unauthorized transactions early.