SA economic updates: trends you need to know

Anúncios

The future outlook for the SA economy is promising, driven by technological advancements, renewable energy investments, and economic diversification, which together enhance resilience and attract investment.

SA economic updates provide a crucial lens on market movements and trends. Are you curious about how these updates can shape your investments? Let’s dive into essential insights that could guide your strategies.

Anúncios

Understanding current SA economic trends

To truly grasp the current SA economic trends, it’s essential to consider various factors that influence the market. Understanding these trends can provide insights for effective decision-making.

Anúncios

Key Factors Influencing the SA Economy

Several elements significantly impact the economy in South Africa today. Economic policies, global markets, and local industry performance all play a substantial role in shaping these trends.

- Interest Rates: Fluctuating interest rates can affect borrowing costs and consumer spending.

- Commodity Prices: South Africa’s economy is heavily reliant on commodity exports, making global prices crucial.

- Political Stability: Government actions and political events can create uncertainty or boost investor confidence.

- Foreign Investment: The level of foreign capital entering the market influences growth and development.

The SA economic trends are also shaped by consumer behavior and market demand. As consumers adapt to changing conditions, businesses must also pivot to meet these needs effectively. This dynamic plays a crucial role in the broader economic context.

Current Consumer Behavior

Recently, there has been a noticeable shift in consumer habits, driven by technology and changing lifestyles. More consumers are turning to online shopping, which has dramatically transformed retail in South Africa.

Additionally, as people become more aware of environmental issues, sustainable products are gaining traction. This growing trend presents opportunities for businesses willing to innovate and adapt to changing market demands.

In summary, by staying informed about the current SA economic trends, individuals and businesses can better navigate the complexities of the market and optimize their strategies for success.

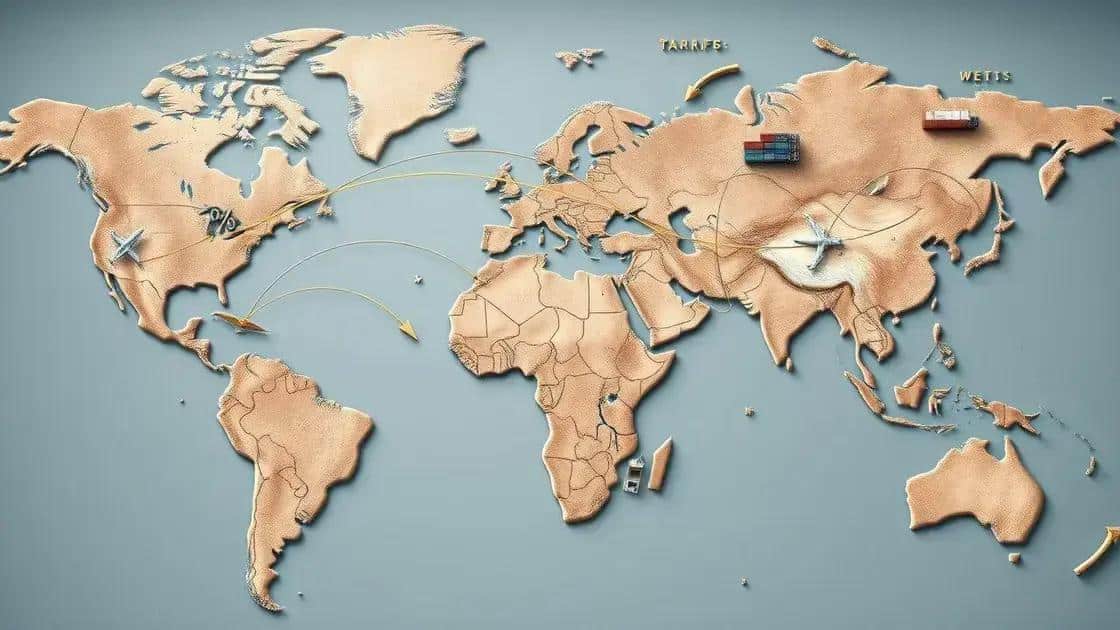

Impact of global events on SA economy

The impact of global events on the SA economy is significant and multifaceted. Changes in the international landscape can cause immediate shifts in economic conditions, influencing everything from trade to investment.

Trade Relations

Global events, such as trade agreements or disputes, can reshape South Africa’s trading partnerships. For instance, when major economies implement tariffs, it can hinder exports and disrupt local industries. A strong dependency on specific markets means that fluctuations can lead to economic instability.

- Emerging Markets: South Africa’s ties with other developing nations can create new opportunities for trade.

- Commodity Prices: Events such as natural disasters or geopolitical tensions often affect global commodity prices, impacting local producers.

- Currency Fluctuations: Changes in other economies can alter the Rand’s value, affecting import and export dynamics.

- Foreign Policy: South Africa’s relationships with major world powers influence investment and aid.

Additionally, the SA economy is affected by global financial markets. Events like economic downturns in developed nations can reduce investment flows into South Africa, leading to slower growth. As global economic conditions tighten, local businesses may face challenges in accessing capital and expanding operations.

Local Responses to Global Changes

South African companies must adapt to remain competitive amidst these shifts. Many are looking for ways to diversify their markets and reduce dependency on a single economy. Embracing innovation and technology is a common approach, enabling businesses to thrive even when external conditions are unfavorable.

Moreover, governments often adjust policies in response to global pressures. Economic reforms or incentives may be introduced to attract foreign investment and stimulate growth. By staying agile and responsive to global trends, South African businesses can position themselves for success.

Key sectors driving economic growth in SA

Understanding the key sectors driving economic growth in SA reveals how various industries contribute to the overall economy. These sectors play a vital role in job creation and national development.

Agriculture

Agriculture significantly impacts the South African economy. This sector not only provides food but also supports many jobs. With modern farming techniques, South Africa has seen increased crop yields, helping to stabilize food prices.

- Diverse Farming: From fruits to livestock, the variety within the sector promotes resilience.

- Export Opportunities: South Africa exports a range of agricultural products, enhancing trade.

- Technology Use: Innovations in farming boost productivity and sustainability.

The agriculture sector continues to adapt to changes in climate and market demands, ensuring its relevance in the economic landscape. In addition to agriculture, mining is another significant contributor.

Mining Industry

The mining industry remains a cornerstone of the South African economy. With rich mineral resources, this sector attracts both local and international investment. Precious and base metals contribute substantially to exports, driving economic growth.

Mining generates jobs, but it also faces challenges such as regulatory pressures and environmental concerns. To thrive, companies are increasingly focusing on sustainable practices, balancing profitability with social responsibility.

Tourism

Tourism is a dynamic sector that impacts various aspects of the economy. South Africa is home to stunning landscapes and rich cultural heritage, making it a popular destination for travelers.

- Employment: The tourism sector provides numerous job opportunities across various skill levels.

- Foreign Currency: International visitors contribute significantly to the economy through spending.

- Local Businesses: Tourism supports a wide range of local businesses, from hospitality to craft markets.

The tourism industry continues to adapt after challenges like the pandemic, emphasizing the importance of sustainability and tailored experiences for visitors.

Overall, the key sectors driving economic growth in SA illustrate the diverse nature of the economy. By investing in these areas, South Africa can achieve long-term economic stability and growth.

Opportunities for investors in SA

Exploring the opportunities for investors in SA reveals a vibrant landscape filled with potential. South Africa’s diverse economy and rich natural resources make it attractive for various types of investments.

Emerging Technologies

The tech sector in South Africa is rapidly growing, offering significant opportunities for investors. Startups in fintech, health tech, and e-commerce are booming, fueled by a young, tech-savvy population.

- Fintech Growth: The rise of financial technology companies is changing how people access financial services.

- Investing in Startups: Venture capital firms are becoming more active, supporting innovative entrepreneurs.

- Supportive Ecosystems: Accelerators and incubators are promoting growth within the startup scene.

Investors looking to tap into the transformative power of technology will find numerous prospects in these areas. Additionally, the renewable energy sector represents another lucrative investment opportunity.

Renewable Energy

South Africa is focusing on renewable energy to meet its growing power demands. The government’s commitment to sustainable energy creates numerous projects needing investment. This shift not only aims to reduce reliance on fossil fuels but also opens doors for profitability.

Investors can participate in solar and wind energy projects, taking advantage of government incentives and a growing demand for clean energy. Some projects are already seeing positive returns, making this sector an attractive option for forward-thinking investors.

Infrastructure Development

As South Africa continues to develop, infrastructure projects are essential. The government emphasizes improving transport, telecommunications, and housing, making it a crucial area for investment.

- Transport Projects: Upgrading roads and rail systems supports economic activity and trade.

- Telecommunications: Expansion of broadband services connects more people to the digital economy.

- Real Estate Development: Growing urban populations create demand for residential and commercial spaces.

Investing in infrastructure not only benefits the economy but also yields significant returns as these projects enhance productivity and connectivity across regions. Overall, the opportunities for investors in SA are abundant, with sectors ranging from technology to sustainable energy and infrastructure paving the way for future growth.

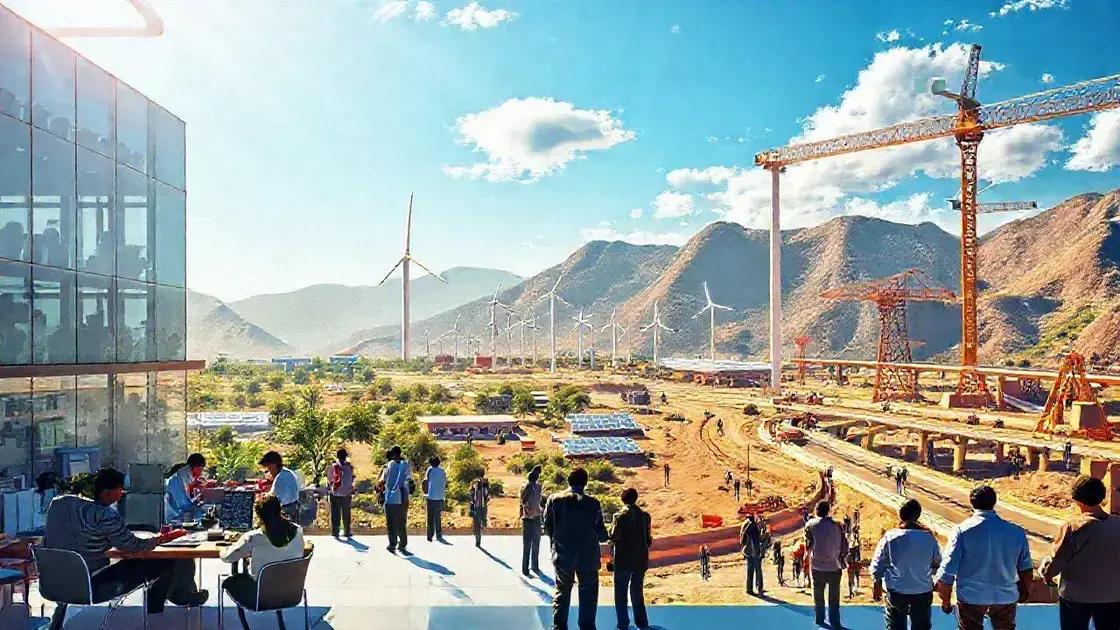

Future outlook for SA economy

The future outlook for the SA economy shows promise, with various trends indicating growth and development. Analysts predict that specific sectors will play crucial roles in shaping economic progress over the next few years.

Technological Advancements

Technology is rapidly evolving and transforming multiple sectors in South Africa. As digital solutions become more accessible, businesses are adopting innovative practices. This shift not only boosts efficiency but also opens up new market opportunities.

- Increased Investment: More investments in tech startups are likely to happen as venture capital increases.

- Job Creation: The rise of new tech industries is expected to generate numerous job opportunities.

- Global Competitiveness: Enhancing technological capabilities can position South African companies favorably on the global stage.

Furthermore, the potential for digitalization in industries such as agriculture and manufacturing cannot be understated. Embracing smart technologies can lead to more sustainable practices and improved productivity.

Economic Diversification

Economic diversification is another key factor influencing the future outlook. By reducing reliance on specific sectors like mining, South Africa aims to create a more balanced economy. This strategy involves investing in various industries, including renewable energy, tourism, and agriculture.

For example, the renewable energy sector is expected to grow significantly. The government’s commitment to sustainable energy infrastructure will attract investment and create green jobs. As the global demand for clean energy rises, South Africa stands to benefit greatly.

Investment Climate

The investment climate in South Africa is evolving, with policies aimed at fostering a more attractive environment for both local and international investors. Regulatory reforms and incentives are creating a friendlier business landscape.

- Improved Infrastructure: Ongoing infrastructure projects will facilitate better trade and connectivity.

- Government Support: Incentives for small and medium enterprises will empower local businesses.

- Foreign Direct Investment: Efforts to attract foreign investors can lead to capital inflows, further benefiting the economy.

Overall, the future outlook for the SA economy combines optimism with strategic planning. By harnessing technological advancements and promoting economic diversification, South Africa is positioning itself for sustainable growth in the years ahead.

FAQ – Frequently Asked Questions about the Future of the SA Economy

What are the key drivers of growth in the SA economy?

Key drivers include technological advancements, renewable energy investments, and infrastructure development.

How does technology impact job creation in South Africa?

The growth of tech sectors generates new jobs and encourages innovation, leading to a more skilled workforce.

Why is economic diversification important for South Africa?

Diversification helps reduce reliance on specific sectors, making the economy more resilient to global changes.

What role does foreign investment play in the SA economy?

Foreign investment brings capital, creates jobs, and fosters economic growth by enhancing local businesses and infrastructure.